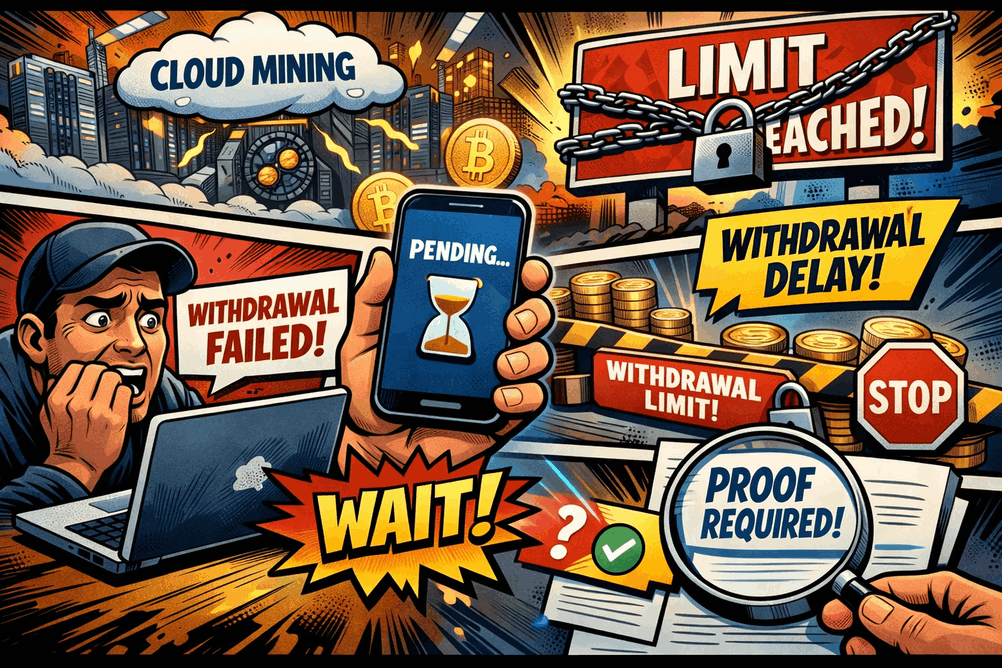

For most users, the decisive moment in cloud mining is not contract activation or daily rewards. It is the cloud mining withdrawal itself. When balances become eligible, how long requests remain pending, and what proof is actually provided once funds leave the platform.

This page looks at withdrawal mechanics as they function in practice across major cloud mining models. The focus is on numeric limits, processing windows, and transparency standards that shape real liquidity, not on promotional claims.

How cloud mining withdrawals are structured

Across the market, cloud mining withdrawals are governed by three operational layers.

First comes eligibility. Rewards must be credited, unlocked by contract rules, and not subject to internal holds. Second are thresholds and fees, which define when a withdrawal request can be submitted. Third is processing, where delays and batching logic appear.

Under typical conditions:

- Rewards are credited daily or per block

- Withdrawal requests enter a batch queue

- Final settlement depends on custody model and network conditions

Most cloud mining payout issues originate from misunderstandings at one of these layers.

Cloud mining minimum withdrawal thresholds

The most common liquidity constraint is the cloud mining minimum withdrawal.

Across established platforms, thresholds usually fall into these ranges:

- Bitcoin payouts commonly require 0.0005-0.005 BTC

- Stablecoin withdrawals are often set between $20 and $100 equivalent

- Internal wallet transfers frequently have no formal minimum, but remain locked inside the ecosystem

For fixed-contract platforms, minimums are often calibrated so users need 7-30 days of accumulated rewards before eligibility. Flexible marketplaces may allow faster eligibility, but offset it with higher network or spread costs.

From a commercial perspective, minimum thresholds reduce transaction volume and network fees. For users, they directly affect cash flow timing.

Withdrawal delays and processing windows

The second major friction point is cloud mining withdrawal delay.

Under normal operating conditions:

- Internal transfers settle within minutes to a few hours

- On-chain withdrawals are processed within 6-72 hours

- During network congestion or compliance reviews, processing can extend to 3-7 days

Delays typically result from:

- Batch processing schedules, often once or twice per day

- Manual compliance checks triggered by account changes

- Network fee optimization, where platforms wait for lower congestion

A delay beyond 24 hours is not unusual. A lack of status updates beyond 72 hours is usually what raises concern.

Proof of payment and verification mechanics

Cloud mining proof of payment is not about marketing screenshots. It is about verifiable records.

In practice, reliable platforms provide:

- A transaction ID for on-chain withdrawals

- Time-stamped payout history

- Status labels such as pending, processing, completed

Different models handle proof differently:

- Fixed-contract providers often issue one transaction per batch

- Marketplaces may aggregate multiple user payouts into a single transaction

- Exchange-integrated platforms show internal ledger entries before generating a public transaction

The absence of a transaction ID does not always indicate non-payment, but the absence of a traceable status usually indicates weak transparency.

Platform models and real withdrawal behavior

Fixed contract providers

Infrastructure-focused platforms such as Bitdeer usually follow predictable withdrawal routines.

Typical behavior includes:

- Daily reward credits

- Minimum withdrawals around 0.001 BTC

- Processing windows of 24-72 hours

- Clear transaction IDs once withdrawals are approved

This structure prioritizes operational stability over withdrawal speed.

Flexible marketplaces

Platforms like NiceHash give users direct control over balances.

Common characteristics:

- Near real-time internal balance updates

- On-chain withdrawals subject to network fee selection

- Frequent micro-payouts increasing withdrawal granularity

- Higher exposure to congestion-related delays

Here, flexibility is high, but users must actively manage timing and costs.

Exchange-integrated ecosystems

Large ecosystems such as Binance and Bybit typically keep mining rewards inside internal wallets.

Observed patterns include:

- Immediate internal availability

- External withdrawals gated by verification status

- Batch processing to reduce network fees

- Internal conversions with spreads usually 0.1-0.3%

These platforms reduce friction inside the ecosystem while increasing reliance on custodial controls.

Common payout issues and why they occur

Most reported cloud mining payout issues fall into recurring categories:

- Withdrawal request submitted below the minimum threshold

- Rewards credited but still locked by contract terms

- Temporary holds after wallet address changes

- Network congestion delaying batch execution

In 2025, many platforms introduced automated security holds of 24-48 hours after account changes such as password resets or KYC updates. These holds are increasingly standard rather than exceptional.

Monitoring, transparency, and planning trade-offs

Withdrawal mechanics directly influence planning.

Platforms that provide:

- Real-time withdrawal status

- Historical payout logs with timestamps

- Clear disclosure of thresholds and fees

allow users to plan liquidity with more certainty.

By contrast, platforms that aggregate rewards without granular records make it harder to reconcile balances, especially when using multiple providers.

How experienced users assess withdrawal reality

Experienced users rarely ask whether withdrawals are possible. They focus on:

- How often withdrawals can realistically be executed

- How much balance remains locked at any given time

- Whether proof of payment is verifiable without support requests

- How withdrawal behavior fits into broader custody and planning strategies

Understanding cloud mining withdrawal mechanics at this level helps readers align platform structure with their expectations around liquidity, transparency, and operational control, before committing capital and before assumptions about returns influence the decision.