The question most users ask today is not which platform pays more, but is cloud mining legit at all. By 2026, the market has matured enough that scams are rarely obvious. Instead of disappearing overnight, many cloud mining scams now operate behind polished interfaces, realistic pricing, and long-term lockups that delay scrutiny.

This page breaks down the most reliable cloud mining scam signs using real market ranges, structural logic, and due-diligence checks that experienced users apply before committing capital. The focus is not fear, but verification.

Why cloud mining scams still work

Most fake cloud mining sites succeed not by promising extreme returns, but by exploiting weak assumptions.

Common patterns include:

- Abstract pricing that hides operating costs

- Long contracts that delay withdrawal testing

- Simulated dashboards with unverifiable data

- Economic models that collapse under basic cost analysis

Understanding how legitimate platforms structure costs is the fastest way to spot cloud mining fraud.

Signal 1: ROI that ignores cost structure

A core red flag appears when projected returns contradict known mining economics.

Under typical conditions in 2025:

- Electricity and operations absorb 60-75% of gross mining output

- SHA-256 hash rate usually costs $25-$55 per TH/s

- Hardware efficiency improvements compress margins over time

If a platform advertises fixed net returns without showing:

- Maintenance deductions

- Difficulty impact

- Contract degradation

it fails a basic reality check. Legitimate platforms model uncertainty. Scam models smooth it away.

Signal 2: Vague or missing operational disclosure

Real cloud mining providers describe:

- Where infrastructure is hosted

- How costs are deducted

- Under what conditions contracts pause or terminate

Scam platforms usually rely on generic claims such as “global data centers” or “AI-optimized mining” without technical detail.

Infrastructure-linked providers like Bitdeer publish contract mechanics, fee schedules, and downtime rules. That level of specificity is expensive to fake and rare among fraudulent operators.

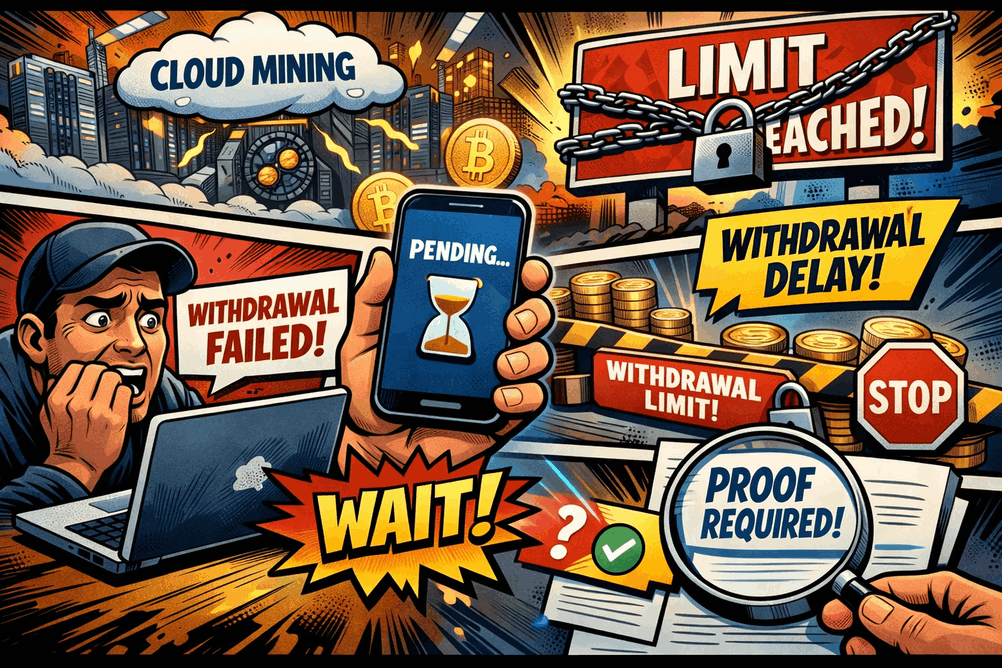

Signal 3: Withdrawal mechanics that delay verification

One of the most effective ways to spot cloud mining scams is to analyze withdrawal logic.

Across established platforms:

- Minimum withdrawals usually fall between 0.0005 and 0.005 BTC

- Processing times are typically 6-72 hours

- Transaction IDs are provided for on-chain payouts

Scam patterns often include:

- Excessively high minimum withdrawals

- Rolling “maintenance” delays extending beyond 7-10 days

- No transaction hash after approval

Delayed liquidity is not always fraud, but unverifiable liquidity usually is.

Signal 4: Simulated dashboards and non-verifiable metrics

Many cloud mining scam signs appear at the interface level.

Warning indicators include:

- Perfectly smooth daily output curves

- No correlation with network difficulty changes

- Earnings displayed only in fiat equivalents

- No exportable payout history

By contrast, marketplaces like NiceHash expose volatile pricing, fluctuating output, and raw performance data. Real mining looks noisy, not stable.

Signal 5: Business model that breaks under scale

A simple stress test reveals many cloud mining scams.

Ask:

- What happens if 10× more users join?

- Are payouts tied to real hash rate or internal balances?

- Does revenue come from mining or from new deposits?

Legitimate models scale with infrastructure and energy access. Fraud models rely on constant inflows and fail once withdrawals exceed deposits.

Signal 6: Ecosystem isolation

Scam platforms often operate in isolation.

Typical traits:

- No integration with major wallets or exchanges

- No internal transfer options

- No interaction with broader crypto services

By contrast, platforms embedded in larger ecosystems such as Binance connect mining rewards with wallets, trading, and reporting tools. Ecosystem integration increases transparency and raises operational costs, making fraud harder to sustain.

Signal 7: Contract terms that eliminate user control

Another common indicator of cloud mining fraud is asymmetric flexibility.

Watch for:

- Contracts that cannot be paused under any condition

- No visibility into remaining contract value

- Unilateral right to modify terms without notice

Legitimate platforms define:

- Activation rules

- Suspension thresholds

- Clear end-of-life conditions

Scam platforms avoid specifics.

A practical due-diligence checklist

Before committing capital, experienced users usually verify:

- Cost structure aligns with known mining economics

- Withdrawal thresholds are reachable within 30-60 days

- Proof of payment includes real transaction data

- Dashboards show volatile, not fixed, output

- Platform explains how it earns revenue

- Contracts define downside scenarios, not just upside

This checklist answers how to spot cloud mining scams more reliably than reviews or testimonials.

How advanced users frame legitimacy

Seasoned participants rarely ask whether cloud mining is safe. They ask whether a platform’s economics are internally consistent.

If numbers line up with energy costs, difficulty behavior, and withdrawal mechanics, the model may be viable. If they do not, no interface or branding compensates for that gap.

Understanding these signals allows readers to evaluate cloud mining scams not emotionally, but structurally, leaving the final decision grounded in mechanics rather than marketing.